Since 2008, 48 states have cut funding from public colleges--some by as much as 40%. State lawmakers couch their decisions as the unavoidable consequence of the Great Recession and budget deficits. What they fail to mention is that while they’re gutting higher education, they’re giving corporations tens of billions in tax breaks and incentives.

State, local, and county governments provide corporations with $80 billion in tax breaks annually, or $9 million/hour, according to an investigation by the New York Times. To put that number into perspective, total tuition at public colleges in 2012 was just under $60 billion, according to theState Higher Education Executive Officers Association.

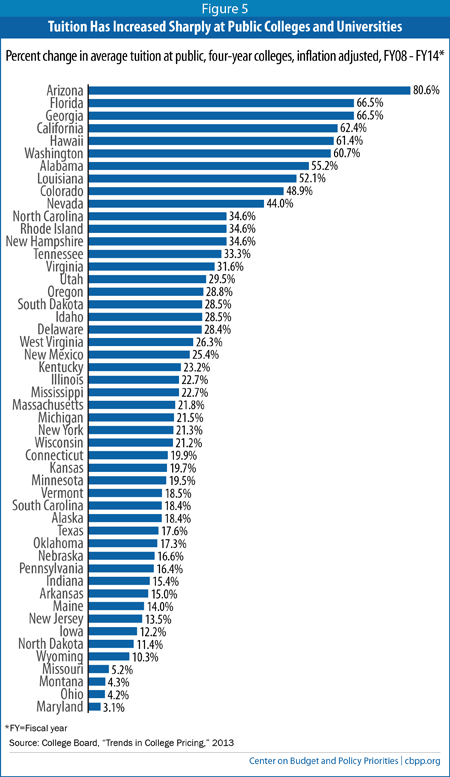

Tuition at four-year public colleges--which educate about 76 percent of American undergrads--has been rising for the past 25 years. According to the Center on Budget and Policy Priorities (CBPP), tuition has increased 28 percent since 2007. There are several factors why college tuition is soaring, but the main culprit is declining support from states, which translates into higher out-of-pocket costs for students.

Michael Leachman of the CBPP points to the perfect correlation between declining state support and rising tuition, “If you look over the last 25 years, per student revenue from state and local government, it fell by about $2,600 after you adjust for inflation...Over the same period, tuition increased by $2,600. So, in other words, the entire increase in tuition at public colleges and universities over the last 25 years has gone to make up for the state and local funding cuts.”

In 1987, students paid close to 20 percent of their tuition. Now students pay close to half.

Defunding education to pay for corporate tax breaks is dubious economic policy. Mark Zandi, chief economist of Moody’s Analytics, estimates corporate tax breaks generate 30 cents in economic demand for every dollar spent on the tax cut. By comparison, investing in educationgenerates $1.50 for every dollar spent--or about 5 times more effective than corporate tax breaks.

Louisiana Governor Bobby Jindal has called for shared sacrifice in tough times, “We are facing back to back years of projected budget deficits and declining revenue...every part of government must cut back...we must all share in the savings as we work to protect critical state services,” he stated on his website. But an examination of Jindal’s budget reveals the burden isn’t being shared at all.

Since Jindal took office in 2008, support for public colleges has been cut by more than $5,000 per student--the largest in the nation. Louisiana’s investment in higher education is now the lowest since the 1950s.

Over the same period, Governor Jindal gave corporations more than $11 billion in tax breaks--at a cost of $2,500 per resident. Oil giant Exxon Mobil received a $263 million tax break which amounts to 97% of the total subsidies received by the company from all 50 states.

Governor Jindal’s single gift to Exxon Mobil is almost equal to the $300 million in additional cuts to public colleges he announced in January. If the cuts pass, Louisiana State University could see thousands of teachers and staff layoffs, departments and campuses closed, and the future competitiveness of the school severely compromised.