At least six people have been jailed in Texas over the past two years for owing money on payday loans, according to a damning new analysis of public court records.

The economic advocacy group Texas Appleseed found that more than 1,500 debtorshave been hit with criminal charges in the state -- even though Texas enacted a law in 2012 explicitly prohibiting lenders from using criminal charges to collect debts.

According to Appleseed's review, 1,576 criminal complaints were issued against debtors in eight Texas counties between 2012 and 2014. These complaints were often filed by courts with minimal review and based solely on the payday lender's word and frequently flimsy evidence. As a result, borrowers have been forced to repay at least $166,000, the group found.

Appleseed included this analysis in a Dec. 17 letter sent to the Consumer Financial Protection Bureau, the Texas attorney general's office and several other government entities.

It wasn't supposed to be this way. Using criminal courts as debt collection agencies is against federal law, the Texas constitution and the state’s penal code. To clarify the state law, in 2012 the Texas legislature passed legislation that explicitly describes the circumstances under which lenders are prohibited from pursuing criminal charges against borrowers.

It’s quite simple: In Texas, failure to repay a loan is a civil, not a criminal, matter. Payday lenders cannot pursue criminal charges against borrowers unless fraud or another crime is clearly established.

In 2013, a devastating Texas Observer investigation documented widespread use of criminal charges against borrowers before the clarification to state law was passed.

Nevertheless, Texas Appleseed's new analysis shows that payday lenders continue to routinely press dubious criminal charges against borrowers.

Nevertheless, Texas Appleseed's new analysis shows that payday lenders continue to routinely press dubious criminal charges against borrowers.

Image may be NSFW.

Clik here to view.

Clik here to view.

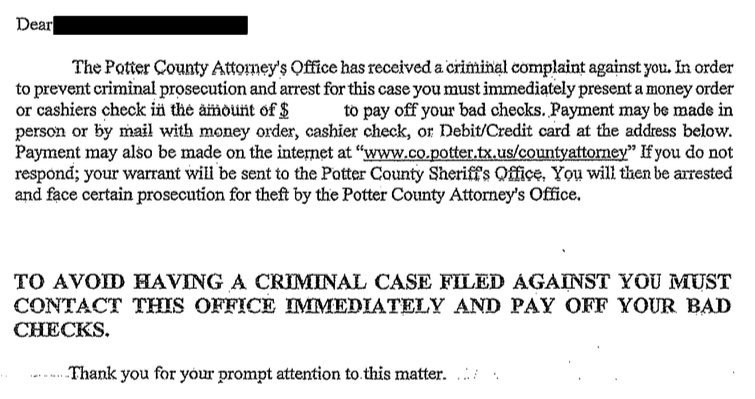

Ms. Jones, a 71-year-old who asked that her first name not be published in order to protect her privacy, was one of those 1,576 cases. (The Huffington Post reviewed and confirmed the court records associated with her case.) On March 3, 2012, Jones borrowed $250 from an Austin franchise of Cash Plus, a payday lender, after losing her job as a receptionist.

Four months later, she owed almost $1,000 and faced the possibility of jail time if she didn’t pay up.

The issue for Ms. Jones -- and most other payday borrowers who face criminal charges -- came down to a check. It’s standard practice at payday lenders for borrowers to leave either a check or a bank account number to obtain a loan. These checks and debit authorizations are the backbone of the payday lending system. They’re also the backbone of most criminal charges against payday borrowers.

Ms. Jones initially obtained her loan by writing Cash Plus a check for $271.91 -- the full amount of the loan plus interest and fees -- with the understanding that the check was not to be cashed unless she failed to make her payments. The next month, when the loan came due, Jones didn’t have the money to pay in full. She made a partial payment, rolling over the loan for another month and asking if she could create a payment plan to pay back the remainder. But Jones told HuffPost that CashPlus rejected her request and instead deposited her initial check.

Jones' check to Cash Plus was returned with a notice that her bank account had been closed. She was then criminally charged with bad check writing. Thanks to county fines, Jones now owed $918.91 -- just four months after she had borrowed $250.

In Texas, bad check writing and "theft by check" are Class B misdemeanors, punishable by up to 180 days in jail as well as potential fines and additional consequences. In the typical "hot check" case, a person writes a check that they know will bounce in order to buy something.

But Texas law is clear that checks written to secure a payday loan, like Jones’, are not "hot checks." If the lender cashes the check when the loan is due and it bounces, the assumption isn’t that the borrower stole money by writing a hot check –- it’s just that they can’t repay their loan.

That doesn’t mean that loan transactions are exempt from Texas criminal law. However, the intent of the 2012 clarification to state law is that a bounced check written to a payday lender alone cannot justify criminal charges.