America has been doing income taxes wrong for more than 50 years.

All Americans, including the rich, would be better off if top tax rates went back to Eisenhower-era levels when the top federal income tax rate was 91 percent, according to a new working paper by Fabian Kindermann from the University of Bonn and Dirk Krueger from the University of Pennsylvania.

The top tax rate that makes all citizens, including the highest 1 percent of earners, the best off is “somewhere between 85 and 90 percent,” Krueger told The Huffington Post. Currently, the top rate of 39.6 percent is paid on income above $406,750 for individuals and $457,600 for couples.

Fewer than 1 percent of Americans, or about 1.3 million people, reach that top bracket.

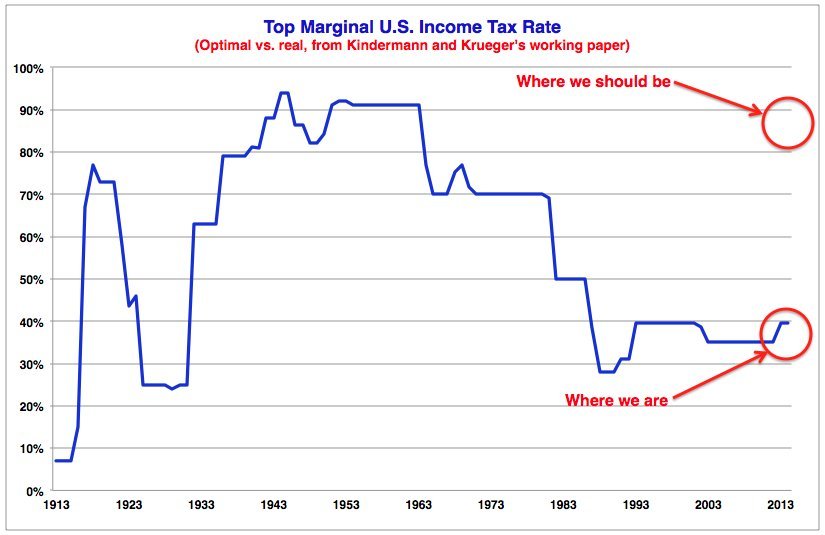

Here is the conclusion from the report, charted:

What you’re seeing is decades of a more or less strict adherence to the gospel that tax cuts for the highest income earners are good. The trend began with President Kennedy, but his cuts were hardly radical. He lowered rates when the American economy was humming along, no longer paying for World War II and, relative to today, an egalitarian dreamland. To put things in perspective, Kennedy cut rates to around 70 percent, a level we can hardly imagine raising them to today. The huge drops -- from 70 percent to 50 percent to less than 30 percent -- came with the Reagan presidency.

In comparison to decades of cuts, Presidents George H.W. Bush, Bill Clinton, and Barack Obama each raised taxes at the top by a historically insignificant amount. Obama also proposed modest tax increases, raising taxes on families making more than $250,000 from 33 to 36 percent, and on individuals making more than $200,000 from 36 to 39.6 percent. These increases failed in the House.

A 90 percent top marginal tax rate doesn’t mean that if you make $450,000, you are going to pay $405,000 in federal income taxes. Americans have a well-documented trouble understanding the notion of marginal tax rates. The marginal tax rate is the amount you pay on your income above a certain amount. Right now, you pay the top marginal tax rate on every dollar you earn over $406,750. So if you make $450,000, you only pay the top rate on your final $43,250 in income.

A very high marginal tax rate isn’t effective if it’s riddled with loopholes, of course. Kindermann and Krueger's paper is also focused solely on income, not wealth, and returns on wealth are how the truly superrich make a living.

Despite these limitations, Kindermann and Krueger say that a top marginal tax rate in the range of 90 percent would decrease both income and wealth inequality, bring in more money for the government and increase everyone’s well-being -- even those subject to the new, much higher income tax rate.

“High marginal tax rates provide social insurance against not making it into the 1 percent,” Krueger told The Huffington Post. Here’s what he means: There’s a small chance of moving up to the top rung of the income ladder, Krueger said. If rates are high for the top earners and low for everyone else, there’s a big chance you will pay a low rate and a small chance you will pay a high rate. Given these odds, it is rational to accept high income tax rates on top earners and low rates for the rest as a form of insurance.

This insurance takes the form of low-income people paying dramatically less in taxes. “Everyone who is below four times median income” -- that’s about $210,000 for households -- “pays less,” Kruger said.